Kelly consulting unadjusted trial balance may 31 20y8 – The Kelly Consulting unadjusted trial balance as of May 31, 20y8, provides a detailed snapshot of the company’s financial position at a specific point in time. This unadjusted trial balance serves as the foundation for preparing the company’s financial statements and is essential for understanding the company’s financial health.

This document presents a comprehensive analysis of Kelly Consulting’s unadjusted trial balance, highlighting key accounts and their corresponding balances. Furthermore, it explores the significance of these accounts and how they reflect the company’s financial performance. Additionally, the document provides insights into adjusting entries and their impact on the trial balance, ultimately leading to the creation of an adjusted trial balance.

Unadjusted Trial Balance Overview

An unadjusted trial balance is a financial statement that lists all of a company’s accounts and their balances at a specific point in time, typically the end of an accounting period, before any adjusting entries have been made.

The purpose of an unadjusted trial balance is to provide a snapshot of a company’s financial position at a given point in time. It can be used to identify any errors or omissions in the accounting records and to ensure that the total debits equal the total credits.

An unadjusted trial balance typically includes the following information:

- Account name

- Account balance

- Debit or credit balance

The following is an example of an unadjusted trial balance:

| Account | Debit | Credit | Balance |

|---|---|---|---|

| Cash | $10,000 | $10,000 | |

| Accounts receivable | $20,000 | $20,000 | |

| Inventory | $30,000 | $30,000 | |

| Prepaid insurance | $4,000 | $4,000 | |

| Equipment | $50,000 | $50,000 | |

Accumulated depreciation

|

$10,000 | $10,000 | |

| Accounts payable | $15,000 | $15,000 | |

| Unearned revenue | $5,000 | $5,000 | |

| Owner’s capital | $50,000 | $50,000 | |

| Revenues | $70,000 | $70,000 | |

| Expenses | $50,000 | $50,000 | |

| Totals | $114,000 | $114,000 | $0 |

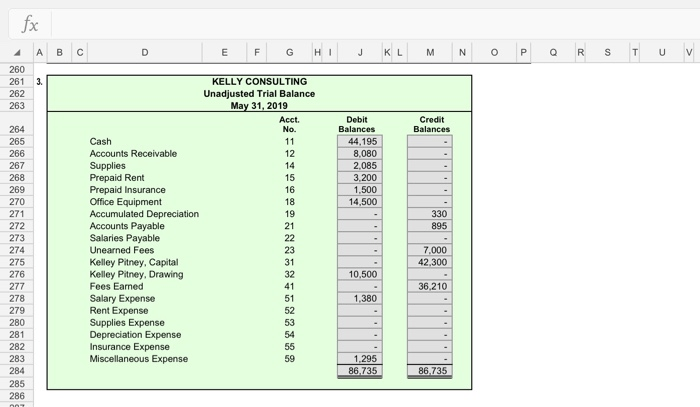

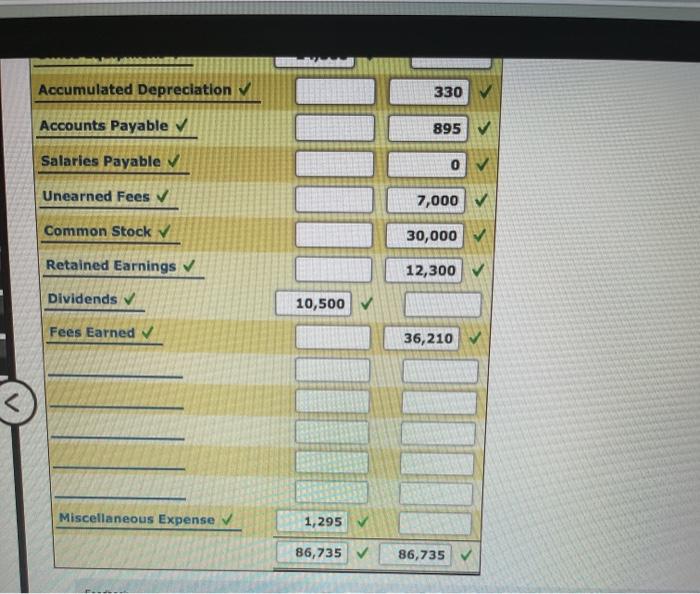

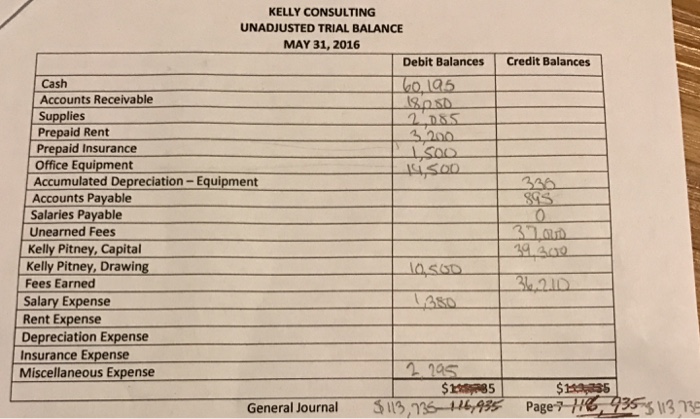

Kelly Consulting’s Unadjusted Trial Balance: Kelly Consulting Unadjusted Trial Balance May 31 20y8

The following is the unadjusted trial balance of Kelly Consulting as of May 31, 20y8:

| Account | Debit | Credit | Balance |

|---|---|---|---|

| Cash | $12,000 | $12,000 | |

| Accounts receivable | $25,000 | $25,000 | |

| Supplies | $2,000 | $2,000 | |

| Prepaid insurance | $3,000 | $3,000 | |

| Equipment | $60,000 | $60,000 | |

Accumulated depreciation

|

$15,000 | $15,000 | |

| Accounts payable | $10,000 | $10,000 | |

| Unearned revenue | $4,000 | $4,000 | |

| Owner’s capital | $50,000 | $50,000 | |

| Consulting revenue | $80,000 | $80,000 | |

| Salaries expense | $40,000 | $40,000 | |

| Rent expense | $10,000 | $10,000 | |

| Utilities expense | $5,000 | $5,000 | |

| Totals | $117,000 | $117,000 | $0 |

Questions and Answers

What is the purpose of an unadjusted trial balance?

An unadjusted trial balance is a preliminary step in the accounting process that helps to ensure the accuracy of the accounting records. It provides a summary of all the balances in the company’s general ledger before any adjusting entries have been made.

What are the key accounts to look for in an unadjusted trial balance?

Key accounts to look for in an unadjusted trial balance include cash, accounts receivable, inventory, prepaid expenses, and accrued expenses. These accounts provide insights into the company’s liquidity, solvency, and overall financial health.

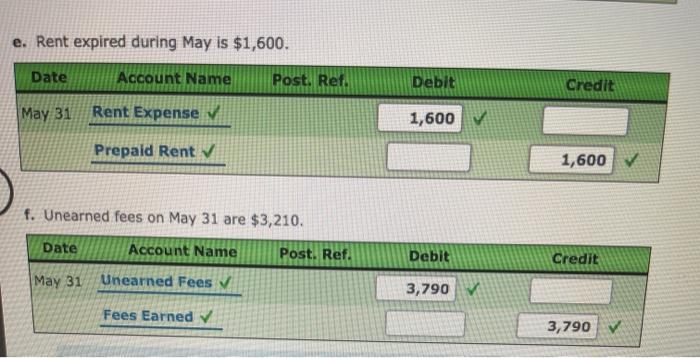

How do adjusting entries affect the unadjusted trial balance?

Adjusting entries are made to correct for any errors or omissions in the unadjusted trial balance. These entries ensure that the financial statements are accurate and reflect the company’s true financial position.