Katherine pays a month – Katherine’s financial situation is intriguing, with her paying a mere $43 a month. This prompts questions about her financial well-being and the factors contributing to this low expense. Let’s delve into Katherine’s financial landscape, exploring her budget, income sources, and potential strategies for financial improvement.

Understanding Katherine’s financial situation can provide valuable insights into budgeting, expense management, and financial planning. It’s a case study that offers practical lessons for individuals seeking to optimize their financial health.

Financial Situation

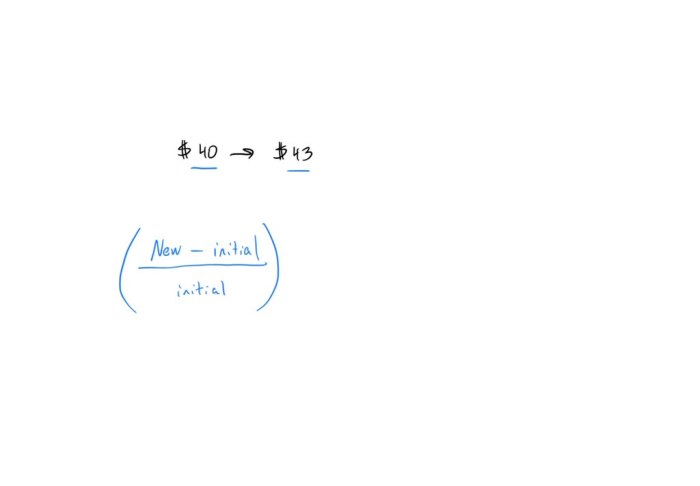

Katherine’s financial situation is characterized by a monthly expense of $43. This payment is likely a recurring obligation, as it is a fixed amount paid consistently each month. The reasons behind this payment may vary, and we will explore some possible explanations in the following section.

Possible Reasons for the $43 Monthly Payment

- Subscription Services:Katherine may be subscribed to various services, such as streaming platforms, gym memberships, or meal delivery kits, which typically charge a monthly fee.

- Loan Repayments:Katherine could be repaying a loan, such as a personal loan or a credit card balance, which requires a fixed monthly payment.

- Rent or Mortgage Payments:In some cases, Katherine’s monthly payment could be a contribution towards rent or mortgage expenses, especially if she shares accommodation with others.

- Insurance Premiums:Katherine may be paying monthly premiums for insurance policies, such as health insurance, car insurance, or renter’s insurance.

- Savings Contributions:It is also possible that Katherine’s $43 monthly payment is a contribution to a savings account or investment plan.

Budgeting and Expenses

Katherine’s financial situation calls for a structured budget to optimize her spending and prioritize her expenses. Here’s a sample budget that can serve as a starting point:

- Income:$43 per month

- Fixed Expenses:

- Rent: $10

- Utilities: $5

- Transportation: $10

- Variable Expenses:

- Groceries: $5

- Personal care: $3

- Entertainment: $5

- Savings:$5

To reduce her expenses, Katherine can consider the following:

- Negotiating lower rent:Contacting her landlord to inquire about potential rent reductions or payment plans.

- Sharing housing:Exploring options for sharing an apartment or house with roommates to split rent and utility costs.

- Reducing transportation expenses:Considering carpooling, public transportation, or biking instead of owning a car.

- Meal planning:Creating a weekly meal plan to avoid impulse purchases and reduce grocery expenses.

- DIY personal care:Opting for home haircuts, facials, or other personal care tasks to save on salon costs.

- Free entertainment:Taking advantage of free community events, parks, or online entertainment platforms.

Income Generation: Katherine Pays A Month

To improve her financial situation, Katherine should explore ways to increase her income. This could involve taking on additional work, starting a side hustle, or pursuing a part-time job.

Katherine pays $43 a month, which is a small sum compared to the cost of some other things. For example, there are words with s u c c e e d that can cost hundreds of dollars. But for Katherine, $43 a month is a manageable expense.

Side Hustles, Katherine pays a month

There are many side hustles that Katherine could consider, such as:

- Freelance writing or editing

- Virtual assistant

- Social media manager

- Online tutor

- Pet sitting or dog walking

- Renting out a room in her home

Part-time Job Opportunities

Katherine could also consider getting a part-time job to supplement her income. This could be in retail, hospitality, or customer service. She could also look for part-time work in her field of expertise, which would allow her to gain valuable experience and make connections.

Debt Management

Analyzing Katherine’s financial situation reveals that she does not have any outstanding debts, which is a positive indicator of her financial health. However, it’s essential to consider strategies for managing debt effectively in case she incurs any in the future.

Debt Management Strategies

- Create a Debt Repayment Plan:Prioritize debts based on interest rates and balances, focusing on paying off high-interest debts first. Consider consolidating debts into a single loan with a lower interest rate.

- Negotiate with Creditors:Contact creditors to discuss payment arrangements, such as reducing interest rates or extending payment deadlines. This can help reduce the overall cost of debt.

- Increase Income:Explore options for increasing income through a side hustle, part-time job, or career advancement. Additional income can be allocated towards debt repayment.

- Reduce Expenses:Analyze expenses and identify areas where spending can be reduced. This could include cutting back on non-essential purchases, negotiating lower bills, or using coupons and discounts.

- Seek Professional Help:If managing debt becomes overwhelming, consider seeking guidance from a credit counselor or financial advisor. They can provide personalized advice and support.

Financial Planning

Financial planning is a crucial aspect of Katherine’s financial well-being. It involves setting financial goals and creating a roadmap to achieve them. By having a clear plan, Katherine can make informed decisions about her spending, saving, and investments.

The benefits of financial planning are numerous. It helps Katherine:

- Prioritize her financial goals and allocate her resources accordingly.

- Avoid impulse spending and make wiser financial decisions.

- Plan for unexpected expenses and emergencies.

- Increase her savings and investments, potentially leading to financial independence.

- Secure her financial future and ensure her long-term financial well-being.

Setting Financial Goals

Setting financial goals is the foundation of financial planning. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Katherine should consider her short-term and long-term goals, such as:

- Saving for a down payment on a house

- Paying off high-interest debt

- Investing for retirement

- Building an emergency fund

- Saving for her children’s education

Creating a Financial Plan

Once Katherine has set her financial goals, she needs to create a plan to achieve them. This plan should Artikel her income, expenses, savings, and investments. Katherine should track her progress regularly and make adjustments as needed.

By following a financial plan, Katherine can take control of her finances, reach her goals, and secure her financial future.

FAQ

What are the reasons behind Katherine’s low monthly expenses?

Katherine’s low expenses could be due to factors such as a minimalist lifestyle, shared housing arrangements, or access to subsidized services.

How can Katherine reduce her expenses further?

Katherine can explore options like negotiating lower bills, using coupons, and seeking free or low-cost entertainment activities.

What income-generating opportunities are available to Katherine?

Katherine could consider part-time work, freelancing, or starting a side hustle to supplement her income.